Read about the latest trends and insights in sustainable building methods — life-cycle assessment (LCA) practices, environmental product declarations (EPDs), and sustainability.

To help policymakers develop legislation and support businesses in achieving their sustainability goals, One Click LCA published the Construction LCA and Embodied Carbon Experts Outlook 2024 report, based on a global survey of construction sector professionals.

Most respondents came from consulting services (close to 40% of all surveyed), followed by engineering, construction management, and architecture and design service providers. In terms of geography, most respondents were from the UK and Ireland (nearly 40% of all respondents), followed by Europe, North America, and the rest of the world. This report follows up on the Construction LCA and Embodied Carbon Experts Outlook report from 2021.

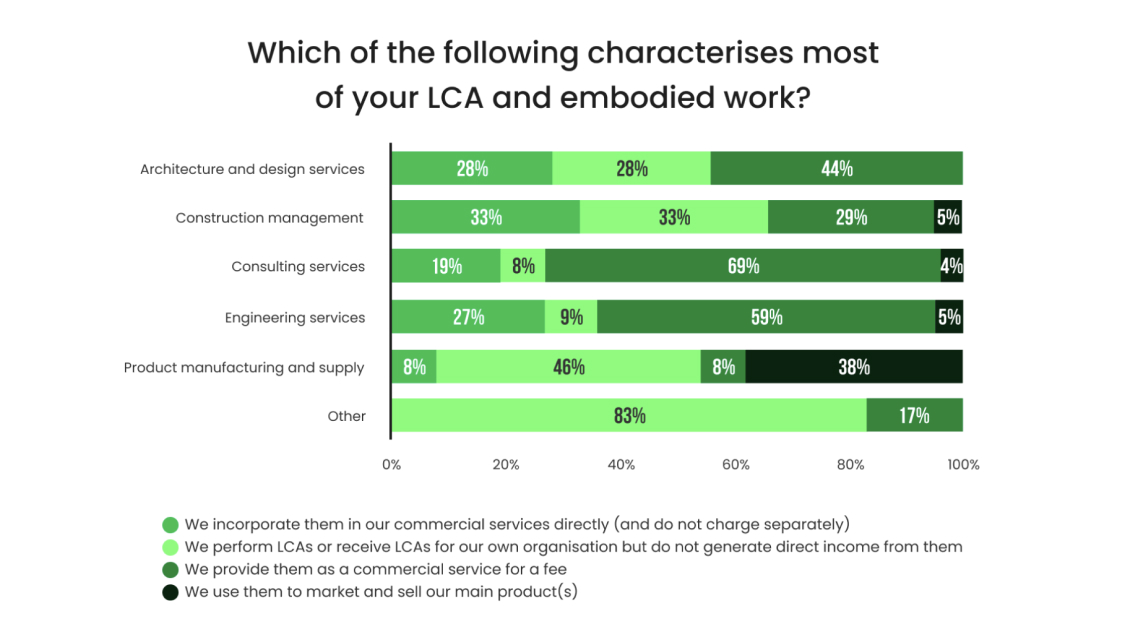

According to the latest report, most respondents from the fields of architecture and design, engineering services, and consulting services stated that their main use case for LCAs and embodied carbon work was to offer them as a commercial service for a fee. In construction management, the primary use was directly for commercial services without charging a separate fee or for internal use. In the product manufacturing and supply field, respondents mostly use LCAs to market and sell their own products instead of generating direct income, which is typical.

In this article, 11 key takeaways from the Construction LCA and Embodied Carbon Experts Outlook 2024 report are highlighted:

1. Embodied carbon & construction LCA trends: can LCA studies achieve 10% or more carbon reduction?

In every market except continental Europe, respondents reported increased confidence that using an LCA or embodied carbon assessment can help decarbonize a project by at least 10% compared to the results from 2021. The biggest jump was in North America, from 41% in 2021 to 58% in 2023, showing that LCA is an impactful approach to adopt. The UK and Ireland, arguably leaders in LCA and embodied carbon studies, have continued to increase their share, which is encouraging.

2. The policy gap: how lack of national regulations affect embodied carbon & construction LCA trends

For buyers of LCA and embodied carbon assessments, the lack of national regulation and policy continued to be perceived as the most prominent issue holding back LCA and embodied carbon progress, with 50% of all replies in 2023. Overall, the top five demand-side factors seen to be slowing progress on embodied carbon and LCA were related to a need for more regulations or policies at the national and municipal levels, as well as a lack of understanding and interest from developers and investors. This means there is a need to educate people about the importance of LCA and embodied carbon; otherwise, it’s difficult to scale the impact on the industry.

When looking at other factors, more than 50% of respondents said the lack of best practices was considered to be “somewhat limiting” progress. There are many ways to address this, including setting targets, circularity, and material efficiency.

3. Embodied carbon & construction LCA trends: top supply-side barriers — lack of manufacturer EPDs

For the parties supplying embodied carbon and LCA studies to customers, there were two major data concerns: 1) availability of data and 2) quality of data. The 2023 results showed that 88% of all respondents saw the lack of manufacturer EPDs as the most limiting factor for LCA and embodied carbon progress compared to 77% in 2021. Additionally, 87% of replies viewed the variable quality of EPDs from manufacturers as an issue hindering progress.

4. Time spent on embodied carbon assessment varies by profession, with most respondents estimating less than 40 hours

Reducing the time needed to perform an LCA has two benefits: 1) It reduces direct costs, and 2) It makes design iterations go faster because you receive design feedback quicker and can get more value. In this survey section, respondents estimated the time spent on an LCA or embodied carbon assessment for a reference 5000 m2 building with the usual level of information available. One Click LCA grouped the replies by field of work based on the assumption that each has its own approaches and purposes.

According to the 2023 report, 55% of construction management professionals needed less than 20 hours for an LCA study. The process is relatively straightforward for them and involves doing it for as-built or as-specified projects. In contrast, for those working in architecture and design services and engineering services, roughly one-third were able to complete an embodied cartoon assessment in that time, with most needing more time because they were likely to do more iterations. Looking at the product manufacturing and supply field, the share of responses was divided evenly between “below 20 hours” and “above 40 hours.”

It’s worth noting that the report showed that optimization work on a project is always much faster than an LCA or embodied carbon assessment. An example would be offering alternatives on a project with an existing baseline. Most respondents across all fields reported spending less than 20 hours on optimization work for the same reference-building project.

5. Overall, respondents experienced workloads higher than their current resources could accommodate

Across all regions, respondents said that the demand for LCA work was higher than their current resources could handle. This issue was especially evident in the UK and Ireland. On the other hand, the rest of the world saw a significant share of responses that indicated current resources sufficed or were more than enough. Additionally, there has been an overall increase in hiring needs for additional employees to conduct LCA and embodied carbon work compared to 2021, indicating a sustained demand for LCAs across all geographies.

6. Embodied carbon & construction LCA trends: technology, process & learning driving 15-30% time savings in 3 years

In 2011, One Click LCA set out to reduce the time spent on an LCA by a factor of 10. We’ve already achieved that. Now, we're aiming for another ten-fold reduction in the next couple of years. Most respondents believed there would be between 15% and 30% potential time savings for conducting LCAs within the next three years. Interestingly, about 15% of the respondents from the most advanced markets, Europe and the UK and Ireland, showed confidence in more than a 45% potential reduction in working time. Despite the unit efficiency, it looks like human resources will be under-supplied.

7. Increased training within the company was a significant action taken to reduce time & costs spent on LCAs across most regions

When asked about actions to reduce costs and time spent on LCAs and embodied carbon assessments, 41% of all respondents stated they had already increased or were planning to increase training within their company. In Northern Europe and continental Europe, 86% and 61% of respondents, respectively, said they prioritize this.

8. Embodied carbon & construction LCA trends highlight automation's role in time savings (34%)

Examining the main underlying factors that enable time savings, the most significant driver across all geographies was seen as the automation of LCA with other software, such as BIM tools. The next most crucial factor was data availability and accessibility, meaning how quickly and easily you can access the data and how well you can use it.

9. Over half of all respondents said that lack of national regulation & policy limits the creation of construction-related product EPDs

An EPD is a third-party verified life cycle assessment made public by an EPD program operator. It's almost always manufacturer-specific, but it can also be product-specific. The demand-side factors limiting the creation of EPDs by manufacturers are entirely different from the LCA ones. However, one common factor that most limits the progress of both is the lack of national regulations and policies. France and The Netherlands are the only places where national regulations require EPDs in the strictest sense.

The availability or cost of EPDs was the second most important factor limiting the creation of EPDs by manufacturers. This is one of the reasons why One Click LCA focuses on making EPDs more affordable. Also, 75% of respondents view a lack of awareness or interest in EPDs as a limiting factor. Since EPDs are published in various formats by different program operators and cannot be found in one place, except for on One Click LCA, data fragmentation was also viewed as a limiting concern.

Looking at the distribution of limiting factors compared to building LCAs, EPDs seem to be around 4.5 years behind in maturity, depending on the market.

10. Most respondents primarily use EPDs for assessing construction LCA projects, except for the field of product manufacturing & supply

Between 74% and 100% of respondents from the fields of architecture and design, consulting, engineering, and construction management said they use EPDs most for LCAs to assess their construction projects. On the other hand, the product manufacturing and supply field uses EPDs for their own products as well as in LCAs to evaluate projects.

When looking at where EPDs are most needed, over 60% of respondents in architecture, engineering, and construction recognize the need for EPD data on mechanical, electrical, and plumbing (MEP) services. This is also one of One Click LCA’s areas of focus — One Click LCA recently launched a new MEP Carbon Tool that helps MEP designers and engineers reduce whole-life carbon in projects.

11. Embodied carbon & construction LCA trends — EPDs drive market advantage in manufacturing (nearly 50%)

In terms of evaluating the influence of EPDs on their business, the report shows that almost half of respondents from the product manufacturing and supply sector believed EPDs would be a key driver to ensure their companies remain competitive in the market. Moreover, every field of work said that using EPDs would impact their internal sustainability goals. Several sectors viewed it as a way to increase demand and generate revenue, with more than half of respondents from engineering services having high expectations for that.

Construction LCA & Embodied Carbon Experts Outlook 2024

The latest trends & insights in low-carbon construction 2024 — embodied carbon, EPDs & more

Learn more

- Read the Construction LCA and Embodied Carbon Experts Outlook 2024 report

- Watch our webinar on the latest trends & insights in low-carbon construction 2024 — embodied carbon, EPDs & more

Carbon Experts Newsletter

Industry news & insights — straight to your inbox

Want to learn more?

Laura Drury • Apr 23 2025

Asha Ramachandran • Jan 23 2025

Asha Ramachandran • May 23 2025

Laura Drury • Apr 30 2025